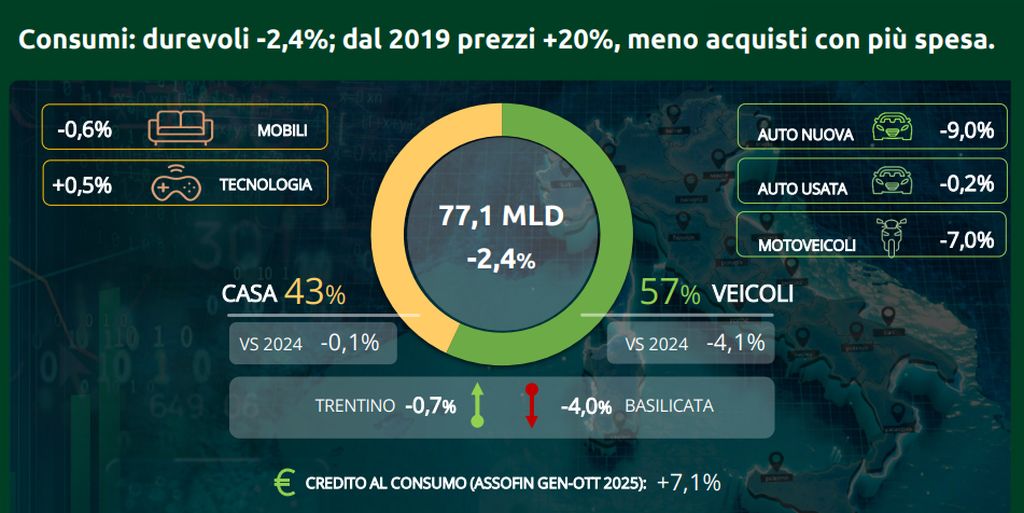

ROMA (ITALPRESS) – After two years of growth the engine of durable goods stops: at the end of 2025 the sector will mark consumption in decrease of 2.3% in volume and 2.4% in value, for a total expenditure that from 79 billion slips to 77.1 billion. It is the photograph taken by the 32nd Findomestic Observatory, created together with Prometeia, for a market that remains on higher levels than pre-Covid, not for an increase in volumes purchased but exclusively for the increase of prices that in 6 years exceeds 20%. To determine the minus sign is above all mobility, the segment that alone is worth 57% of household spending in durable goods. Here the braking is evident, with new cars falling by 9% to value. The house – furniture and technology – is instead stuck in a stagnation that lasts from 2023, after the exploits of the post-pandemic three years. On the territorial front, the three historical locomotives – Lombardy, Lazio and Veneto – lose between 2.6 and 2.8%. Emilia-Romagna (-1.8%), which almost hooks the podium in the graduation for spending volumes. “ This year durable goods suffer more than other compartments. While services, food and other goods grow – according to Istat data – our perimeter returns negative after two years of expansion, that of 2023, driven more by inflation than by real volumes – says Claudio Bardazzi, head of the Findomestic Observatory -. We will close the 2025 with a -2,4% value, which results in a real reduction of the expense of the beans. For Bardazzi we are still on higher spending levels of 11.4% in 2019, but this does not mean that you buy more. The real engine was the price increase, near +20%. Net of inflation, i.e. looking at volumes, consumption of durables is actually 6.8% below pre-pandemia levels.” In this braking framework consumer credit goes counter-tendence, a tool that families are using to react to uncertainty. Marco Tarantola, CEO and General Manager of Findomestic Banca: “With consumption falling in the world of durables, the credit market continues to grow. In the first ten months of the year the issues mark a +7%, with the risk that remains on very low levels (1.7% the default rate at the end of September 2025, while showing a slight increase over the year. It is the confirmation that consumer credit plays an essential social and economic role: it helps families not to give up their projects in a context that remains complex.” The most striking data comes from the investigations conducted by the institute: “Over four Italians out of ten – recalls Tarantola – have used a form of credit at least once in the last three years. And more than 60% of those who did so declare that, without this possibility, it should have postponed or completely renounced the purchase. Data confirming that credit today is a lever of trust, not only a financial product”. If Italy slows down, every territory does so with its style. There are regions that absorb the shock better. In Trentino-Alto Adige, where income remains high and the economic climate is less nervous, the decline is only -0.7%, the best in Italy. More surprisingly the estate of Sicily and Liguria, both firm to -1.3%: two distant territories geographically but united by an internal question that resists. On the contrary, in Basilicata the market of the durable yields 4%: a bending that is not only statistical but structural, made of fragile consumption and little demographic thrust. The slowdown was also consistent in Piedmont (-3.5%), Molise (-3.3%), Abruzzo and Lazio (both -2,8%). On the level of absolute values, Lombardy continues to play another championship: 15.4 billion, more than double Lazio, which follows 7.5. It is the locomotive that pulls the country, even when the convoy stops. In 2025 the Italian mobility market lives a double speed: the used keeps the line, the new slows down, the two wheels correct the race after years of sprint. Since 2017, that of used cars is the first market for absolute value and continues to demonstrate it. The inflation effect is obvious: you spend 25% more than 2019 to buy just 3% more cars. In 2025, after two years of growth, the sector slows down and its turnover will close with a -0.2%, substantially in stall, with the increase of ownership passes (+2.1%) canceled from the decrease of prices (-2.1%). But the values remain solid: 24.4 billion euros, almost 8 billion euros more than the new car, thanks to a demand, in recent years, increasingly oriented to savings. Prices in decrease and mix of sale more ‘popolarè confirm that the consumer is cautious but active. For new cars, braking is clear: -9% in value, with the expenditure of households falling to 16,5 billion. Registrations decrease (-9.9%), prices remain stable (+0.8%) after years of strong growth and the mix moves on more expensive bands and technologies. The city car, once a spinal cord of the market, passes from 17% of 2019 to 12%. Private demand remains far from pre-pandemia levels: -25% registrations compared to 2019, -10% expenditure. It is not enough incentives to hiccup families, to take hold with a reduced purchasing power compared to a few years ago and with a context of persistent uncertainty. After four years of growth, comes a stop for motorcycles: -7.7% volume in 2025, -7.0% value. But the comparison with 2019 remains impressive: +36% at volume, +55% at value, for a market worth 2.75 billion and which has benefited in these years of a question, which in a context of inflation and fall of purchasing power, has seen in two-wheeled vehicles a low cost alternative to the second or third car in the family. The decline of 2025 underwent differentiated dynamics between mopeds, in sharp decrease (over -30% to volume), and plated, in better seal (-6% approximately to volume) and on historically high levels. The scooters registered climb 8.8%, confirming themselves as protagonists of urban mobility. From furniture to household appliances, from electronics to telephony and IT, the house compartment in 2025 shows a picture of stability and adaptation. Developing IT products, small appliances and smart devices, the online consolidates the key role, while families and consumers favour comfort, quality, well-being and premium solutions, between innovation and attention to price. After the 2021-2022 golden two-year period, the demand for furniture was normalized, but the sector remains well above pre-Covid levels: +10% compared to 2019. The year will close around 16,5 billion euros (-0.6%), reporting a phase of settlement more than a real slowdown. The volumes remain in decline (-1.7%), but the prices continue to support the market (+1.1%), although with a softer dynamic than the years of the risers. Family caution still weighs: incentives and bonus renovations help, but not enough to rekindle that exceptional boost generated by post-pandemia and Superbonus. To stop is above all the question linked to the renovations, today physiologically downhill. In the first six months of the year, residential sales grew by 9.5%, driven by lighter rates and a more accessible credit. On the front of the sales channels, the online continues its advance reaching 20% of the retail. A result that certifies the digital maturity of Italian furniture, increasingly capable of combining design, price and omnichannelity. The telephony remains the centre of consumer technology: in 2025 the sector keeps the course on 6.3 billion (-0.4%), a sign of a mature demand that however evolves rapidly. The smartphones – 85% of the turnover – slow down in volumes but keep in value (-1.1%) thanks to the continuous shift towards the highest quality products. To counterpoint the bending of the smartphones, continue to grow headphones (+1.5%) and wearable technological devices (+1.2%), driven by smart functions increasingly oriented to wellness and personal performance. The online consolidates the overtaking of sales in the store, reaching 20.5% of turnover. In a saturated market, it is here – among premium services, integrated ecosystems and new models of use – that you play the future game. The household appliances market will close on 2025 with a total value of 6.5 billion euros: 4.2 billion for large appliances and 2.3 billion for small ones. Large household appliances are confirmed on a high plateau (-0.3%), after three years of solid growth, supported by the needs of replacement and energy efficiency driven also by the scrap bonus. The volumes keep, the prices cool, and the washing compartment is the one that runs best: dryers (+4.4%) and dishwasher (+1.7%) drive the high end of demand, signal of an Italy that updates the domestic equipment pointing to comfort and savings. Cold and cooking remain weaker, with downhill prices that compress the overall value. All other story for small appliances, once again the best performers among the durables for the house: +8.4% in volume and +5.2% in value. The market intercepts clear trends: multifunctionality, self care and desire for simplification. The new generation of vacuum cleaners and mini-aspirators are gradually growing. In the care of the person, dental hygiene products shine (+9.6%), shaving devices and hair dryers. In the preparation of food, air fryers continue their scale (+16% in value, +23% in volume), while kitchen robots live a phase of strong normalization due to promotional pressure. Among other products, continues the development of balance sales (+9.1% in value). The online is consolidated as a key channel: it now accounts for 38% of the turnover of small household appliances, with double digit growth. “From air fryers to wearables, from oral hygiene products to body care equipment, a growing search for personal well-being emerges – Bardazzi points out. The consumer invests in what allows him to live better: monitor, prevent, simplify. Even at home.” After a triennial of less signs, the Italian IT market returns to grow, marking a +1.7% and venting the 2.2 billion turnover. To drive the recovery are portable pcs (+3.5%), tablet (+4.7%) and devices for the game (+5.3%). The online channel is the protagonist, with a contribution to turnover near 32%, compensating for the slight decrease in sales in physical stores. After rebounding from peaks of 2020-’21, the IT market ranks among the most performing segments of consumer technology, with growing volumes and a favorable price dynamic that lets you see further positive trends for the closure of the year. In addition, 2025 will close to 1.6 billion (-1.9%), the consumer electronics market continues to meet the long wave of the shift to digital terrestrial: the video segment, still in bending, remains the big brake of a compartment that however shows signs of stabilization after the collapse of the triennium 2022-24. TV – which is worth more than 80% of the market – remains negative (-2.9%), although from mid-year volumes come back to breathe. The decoders continue their free fall, now under 1% of the turnover. Among the few lighthouses, the drones stand out (+16%), the headphones (+6.6%), driven by wireless and premium functions, and the speakers (+7.6%), powered by the desire for home theater. A market that tightens teeth but that – between innovation, sound quality and new listening experiences – lets you glimpse the desire of consumers to return to invest, when the rebound from the post-switch-off boom will finally be behind you.

– photos from Findomestic Observatory –(ITALPRESS).